Want to learn more about home equity lines of credit? You’ve come to the right place! In this episode of Get Fundable, Merrill Chandler explains what HELOC is and reveals just how it impacts your fundability™. He breaks it down the concept and the rules you need to follow to make the most of your HELOC. Merrill also shares what makes it better versus other credit lines. Tune in to learn how you can create more wealth with inexpensive money through your home equity!

—

Watch the episode here:

Listen to the podcast here:

The Truth About Home Equity Lines of Credit and How They Impact Your Fundability™

In this episode, all things HELOCs, Home Equity Lines Of Credit. I promise you, it is unlikely you have had this much detail about how to use, acquire, leverage, and profit using a HELOC. We are going to get down and dirty with what is, to me, the most sublime credit line available to homeowners, how to get one for yourself and how to use it.

—

What is HELOC?

I promised you HELOC madness. We are going to talk mad and awesome about HELOC. What’s a HELOC? It’s a Home Equity Line Of Credit. Like the title, the Moniker says, “It is a credit instrumental that is usually given by mortgage brokers and loan officers to cover or give access to the equity that is in your home.” Now, we are going to be talking about residences because typically, your big lenders don’t do HELOCs on secondary or investment properties. HELOC is your home, your residence. They are an amazing instrument.

If you have been to my Bootcamp, you know that I talk about business lines of credit all the time. The only credit instrument that, in my estimation, beats a business line of credit for versatility, the least expensive money available, and the most opportunities is a HELOC. Let’s do a deep dive. For those of you who are studying the best way to use this HELOC, take notes. Pay attention because this home equity line of credit is a game-changer for you.

First things first, as I said, it’s a credit instrument that is used against the equity in your home. For example, let’s say you have a $100,000 home or you are buying a $100,000 home. You put down 20%, so you put $20,000 down. Your mortgage, the installment loan against that, the home loan value is $80,000 in this example. That leaves $20,000 of equity because you put your skin in the game. You put your money into that deal.

Home appreciation is free money. Click To TweetLenders sometimes, at the very beginning of doing this deal will do what’s called an 80/20. They will do 80% on a first and do a 20% HELOC because you put the money down, so the equity already is in the home. It’s almost like a secured credit card except on the equity of your home. You are backing a credit instrument, a HELOC, home equity line of credit, with the equity in your home. You have an $80,000 first and, in this case, you would have a $20,000 credit limit backstopped by the equity.

How HELOC Affects Your Fundability™

Now, as your home appreciates, you can keep whatever you are paying down. As you learned in Bootcamp, you stay ahead of the payment slope. Let’s say you are throughout a couple of few years. You pay the $80,000 to $70,000. You have more equity available. Also, let’s say your payment or your equity grows, the home value grows to $110,000. If we pay down $10,000 of that $80,000 to turn it to $70,000 and we then experience an appreciation of another $10,000, you have a $20,000 credit line but you have $40,000 now in equity. You can refinance the equity in your home and increase this home equity line of credit.

Why do we want to do this? First of all, appreciation is free money. Second of all, you are making payments, whether you are going to use the equity in an equity line or not, you are going to be making payments, which lowers the balance. This spread between the value of your home and that first is a perfect opportunity to have a line of credit that’s backstopped by the equity of your home. Now, think of it this way. The value of a home equity line of credit is extremely inexpensive money. Many times, this credit line will allow you to use any amount and pay it off.

Let’s say that we still have our original $20,000. You do a wholesale deal. If you are a real estate investor, you buy something over here. You do home improvements, whatever it is that you do. Let’s say you use $5,000. You write a check or use the credit card, the plastic that comes with these credit lines. You use that and you spend $5,000. You only have to make payments on the $5,000. That’s the beauty. You are not taking out a loan in this case of $20,000. There’s a credit line to use whatever amount you wish of that $20,000. Let’s say you use $5,000. Now, you can do 1 or 2 things.

Most institutions, banks, and lenders allow you to make an interest-only payment. Many of them on their websites will say, “Here’s a minimum payment, which creates a pay down to zero or this payment over here is to pay the interest that you are accruing.” Depending on how you are using that money. If you are using it to pick up another property, create a value where you are leveraging the money, you are using from this credit line to build more money or create more money than interest only. That’s a phenomenal return on your money. These instruments are amazing.

As I said, these home equity lines of credit from traditional lenders and banks usually apply only to your residents. What about if you have a commercial endeavor? What if you have a commercial building? What if you have investment properties? Other commercial lenders are not the big banks, etc. We can’t call them private because they are public entities. Some of them are backed by hedge funds, some by private investors but there are groups out there that will lend on the equity of any property you have like commercial properties or residential properties and come in two types.

HELOC: HELOC is the only credit instrument that beats a business line of credit for versatility, the least expensive money available, and the most opportunities.

They have loans based on your equity. Let’s say you have $1 million in properties. It’s ten properties and the value of each is $100,000. Between paying it down and appreciation, you have $500,000 worth of equity between all ten of these properties. It doesn’t matter if it’s your personal residence, investment properties or commercial properties. They will lend on the equity that you have inside of that aggregate or compilation of investment properties. These are awesome investment opportunities because now, you are not working with commercial banks. The money is a little more expensive. When I say a little more if you are an experienced investor, some of these may offer you one point above what tier 1 and tier 2 banks are lending on.

Rules To Follow When Using HELOC

They tend to lend based on the equity involved and your experience as an investor. The more experience you have, the more success you have had, the lower your costs and the better the terms. I want to show you that there are home equity lines of credit but then there are pledge loans, blanket loans, blanket lines of credit that will use to backstop the credit lines or the loans will use the equity in all your properties or investments properties. Technically, HELOC, Home Equity Lines Of Credit, only are on your personal residence. As I said, the funds are very versatile but there are a certain couple of rules that you need to follow.

As I have been saying, “You can use these funds for business purposes, even though it’s on your residence and loan is on your personal credit profile. Even if you have deeded it to a business, you need to be very careful about how you use these funds.” Talk to your CPA and tax advisors but generally speaking, you do not want to use your home equity line of credit, that credit line, for both personal and business purposes. You don’t want to go on vacation using it, and then you don’t want to go over there and rehab a house using it because the IRS is very specific and the litigious nature of real estate holdings, etc. You don’t want to pierce the corporate veil.

What you do is lease or rent this credit line to your business. For those of you into the Bootcamp, my most successful clients tend to lease their home equity line of credit to their QFE. If you don’t know what a QFE is, go to Bootcamp, GetFundableBootcamp.com. Find out because there are some amazing tools and strategies available for you to be able to leverage your home equity line of credit.

The other important thing is that if you are going to use it for business, then you need to have a piece of paper in the notes, your corporate Bible or your corporate book. You need to have a lease agreement. It’s a very simple one-pager. You can talk to your advisors about how to do this but you simply say, “I’m leasing this credit instrument to the business to expand that business.” Having done that, you can now use that and have the business pay the interest payments. Use it for the business as you wish but you can’t use it for your family vacation.

You want to make sure you use it for personal or business. I defer to your CPA or your tax advisors. You can say, “This $10,000 of my $20,000 HELOC is dedicated to this one transaction but I will leave that to your other advisors to figure that out.” To make it simple, all business or all personal. Those things are very important. That way, you don’t pierce the corporate veil. That way, if somebody is trying to take advantage of you, sue you or otherwise, and they are looking at bank records and you say, “You are using this home equity line of credit for anything and everything,” that’s going to ultimately get in your way. That’s going to harm you and we do not want to do that. Again, I defer to your CPA or tax advisors for the specifics of those decisions.

Don’t use your home equity line of credit for both personal and business purposes. It has to be either all business or all personal. Click To TweetHere’s what’s interesting. How does lender software and how does FICO evaluate a HELOC? It is a real estate-backed credit instrument. It’s messed up but again, I refer you to GetFundableBootcamp.com if you want to find out about how all these things work. In the Bootcamp, we talked about credit instruments for revolving accounts. There are sixteen different variations on your credit cards, charge cards, credit lines, etc. but what’s not included by FICO and lender software in those sixteen, HELOCs are treated like a real estate-backed loan, an installment loan. They are not treated as a credit line.

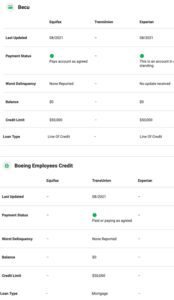

In the documentation, we fill out on the credit line. On HELOC, we don’t include it in your revolving accounts portfolio even though it’s a revolving account. I want to show you now what that looks like. Even the different credit bureaus register it differently on your credit report. Notice at the top, it says BECU. Down in the middle, that represents Boeing Employees Credit Union. There are two listings. Equifax and Experian are listed as a line of credit. That’s a HELOC right there. What you are seeing is a $50,000 line of credit but TransUnion counts it as a mortgage as an installment loan.

Even the bureaus report it differently but straight from FICO’s development team in our Q&A with them, they treat all HELOCs, home equity lines of credit, as a real estate-backed loan. That means as you will learn in Bootcampers if you remember from the Bootcamp loans don’t move the needle as much. Not all but most loans are guaranteed in some fashion. Like a mortgage is guaranteed, it is backed by your house. If it’s a Fannie, FHA or Freddy, it’s backed by the Federal government if it fails. Auto loans are backed by an automobile and are secured by the automobile. Even your student loans are secured by the Federal government to reimburse a lender if, for some reason, you are unable to pay.

Some loans are unsecured like personal loans, etc. Many of them have some guarantee or security to them that FICO doesn’t cause them to move the fundability™ needle, the score needle, as much as unsecured credit cards, charge cards and personal credit lines. We have to keep those separate. Unsecured, revolving accounts, credit cards, etc. are huge risks and balances there moves the fundability™ needle a ton, not so with installment loans. In this case, from this presentation, not so with HELOCs. HELOCs do not move the needle, so you can have a high balance on this revolving account and still not get a huge downgrade if you have high utilization, downgrades of fundability™, and a lowering of your score.

For example, if you have a $50,000 like an example from this Boeing employees credit union and you charge it up to 95% on a HELOC, there’s going to be a 10, maybe 15 points lowering of the score and not much lowering of your fundability™ because it’s backed by an appreciating asset. If you have a $50,000 credit card and you charge that up to 95%, your score, and your fundability™, your attractiveness to future lenders is going to plummet. See the difference? That’s one of the reasons why I love HELOCs of use in your business expansion, real estate endeavors or anything that you are using in your wealth strategies even though it’s on your personal profile, it doesn’t move the funding needle very much. Having a high balance there, it’s not going to lower your score or your fundability™ very much.

HELOC: As your home appreciates, you can keep whatever you’re paying down. You can refinance the equity in your home and increase the amount of your equity line.

This is very important for us to cover. We need to understand this. We go into, again, a great deal in the Bootcamp. One of the things we need to learn here in this presentation is if you use the same type of relationship-building philosophies and implement our Bootcamp strategies inside the HELOC, it doesn’t get you higher limits like it would on unsecured. Unsecured, we want automatic limit increases but every HELOC you have out there will not give automatic limit increases because you have to reapply because they need to reevaluate the value of the property, see how much equity you have based on an appraisal, and then raise your credit line.

One of the great things about unsecured business lines credit and credit cards is you can get automatic limit increases. That is not the case with a HELOC. You have to go through an entire re-evaluation of the value of the property, how much equity you have, etc. There are certain things that we have to be careful of on HELOCs but the use of funds is not one of them. We get to use those funds powerfully.

How To Make The Most Of Your HELOC

It is one of the super-powerful uses of a home equity line of credit because it is such a low-cost credit instrument. My dear friend and a brother from another, George Antone of Fynanc.com, teaches the master sweep account and encourages the use of the lowest credit instrument, which in most cases is a HELOC because it works best when you use it as your master sweep account. Way beyond the scope of what we are talking about here, a master sweep account is a wonderful tool for getting out of high limit utilization and right-sizing your debt load for optimal fundability™. It’s a wonderful strategy to do that. You can check out his information and more importantly, we have a Master Sweep Account Podcast at GetFundablePodcast.com.

A master sweep account is also known by some as infinite banking. It simply means that you are becoming your own banker where you borrow money from to pay other instruments down and invest in other opportunities like a bank would do and consolidation loan for us to help us pay down our revolving accounts. Imagine a 22% credit card with a high balance. We want a debt transfer of a 5% or 6% home equity line of credit to pay down those revolving accounts. Wherever you have equity, we love the home equity line of credit as that master sweep account.

That was a lot. We have covered how credit bureaus rank it, how FICO evaluates it, and we have talked about using business strategies or your personal loan, and infinite personal bank for you to build as a family bank. In closing, I love HELOCs. Wherever I can, I want to help you and each one of you build this bank. The final thing I would like to cover is credit invisible, the unbanked or the people who do not currently own homes. They talk about homeownership is like the first and the greatest thing that you can do to build wealth because of the natural increase in appreciation, the 99% of our historic property, even after 2008. They reset and now most properties are worth more than at the height of that crash.

Equity in your homes is like free wealth that’s being delivered to you. If you use it, and you use it well, you're able to leverage the value of your home to create more wealth. Click To TweetEquity in your home is like free wealth that’s being delivered to you. The way to do this free wealth and access it is through home equity. For all of those first-time home buyers, you are getting out there, ask your mortgage broker about 80/20 loans. That 80% is a first and 20% is the second position home equity line of credit.

I do want an advanced strategy for some of you who have found it because you are totally passionate about getting out of debt and you want to pay down your mortgage as fast as possible. People who don’t want to be consumers, even they want to become a savvy borrowers but you may not be interested in business borrowing. Even if you are in business, borrowing, here is my favorite of all HELOC strategies. Instead of getting a first position loan, like a home loan or first mortgage, imagine getting a first position HELOC, especially for those of you who have paid off your loans.

Let’s use the same example. Let’s imagine you have a $100,000 valued house and you have no mortgage on it. Getting a HELOC placed on it, that’s where the investment comes in. They may have some closing costs you have to pay for but now, let’s say they have given you an $80,000 credit line. A home equity line of credit against the value of your paid-off house.

You don’t have any payments to make whatsoever unless you use it but if you use it and you use it well, you can leverage the value of your home to create more wealth, whether you are a first-time homebuyer looking at it, always ask your mortgage brokers or loan officer, “Can I get a home equity line of credit as my first?” People will say, “What’s the difference between a line of credit and a loan?”

If your home is paid off, it’s worth $100,000 and they gave you $80,000, you now have an $80,000 credit line that when you use it, isn’t going to make you unfundable by using it like you would if you used an unsecured credit card on your personal profile. Business credit instruments are different. If done right, they don’t change your fundability™ but imagine an $80,000 credit instrument, you can do this.

HELOC: The more experience you have, the more success you’ve had, the lower your costs and the better the terms.

Let’s say you are a first-time homebuyer and you want to do a HELOC but the HELOC is going to be tapped out. It’s $100,000. You put in your $20,000 but you want the first to be HELOC. It would be a tapped-out, 100% home equity line of credit, and then you would have a little extra above that because most of the lenders want some of your skin in the game, so you’ve got to put some money in there. Now, they may go to 100%. More likely, they are going to go to 80% or 90% of that $100,000. There’s no credit limit to use but anytime you have windfalls of cash and you start paying down this credit line, you are increasing how much available credit, you don’t have to get what you have and you don’t have to go get a new loan. If you do this with an installment loan first, like most traditional first, then you have to go through the refinance process to tap your equity from appreciation or pay down.

The Downsides of HELOC

If you get a home equity line first, then every time you make a payment, you have more credit line to use, you do your deals, you make payments, and that balance goes down but that balance is now accessible. It’s one of the greatest tools and I highly recommend it to anybody who fits the criteria and where it makes sense. A home equity line of credit has a couple of downsides.

One, generally speaking, it’s a variable rate interest. If inflation goes up, your payments are going to go up based on the home equity line, so it’s not a 30-year fixed. It could be a downside if you are looking for the lowest possible cost on your mortgage, then anytime that you want to access equity, you are going to have to do a refinance of that smaller equity line on top of your first to access your money. Even that one will be variable rate interest.

The question is, to use our example, what can you make with $50,000 or $80,000? How good of a real estate investor, business owner or business entrepreneur are you at investing that money for a return? It might be worth it to have a little higher risk, talk to your CPA and your tax folks but it may be worth the higher risk for the cost of this variable rate HELOC for the amount of return you can get on your money.

I can’t guarantee that you are an amazing investor. I can’t promise you anything but you can look at your track record and if you are good at the deals that you do, the investment that you do, or the choices you make for passive income investments, whatever your game plan is, your wealth strategy, all of that can be facilitated with a home equity line of credit.

HELOC: Home ownership is the first and the greatest thing that you can do to build wealth because of the natural increase in appreciation.

If you are reading this show, like, review, share, subscribe, join our community so that we can keep going and you can binge all of this high-level, awesome stop. If you are on our Get Fundable Facebook page, please like, love, share and point this out to anybody who’s buying a home and anybody who’s refinancing. Share this episode with them so that they know what possibilities exist and create the best possible options for them. Give us the loves, give us the likes, and make sure that you can like, comment, share with all your friends and family. Let’s do this. Let’s leverage all the tools and strategies that we have to create wealth for us, our loved ones and have an amazing life.

Important links:

- Fynanc.com

- Get Fundable – Facebook

- GetFundableBootcamp.com